Yes – you can help get your son or daughter through college with little or no student loan debt! If you are the student there are also plenty of things you can do to prevent or minimize student loans as well. The purpose of this article is to break down the options and present some real world examples. Let’s go!

Be Realistic with your College Choice

It starts with your choice of college. Just like buying a car, there is a huge difference between a Chevy Malibu and Corvette. The thing is, both will get you where you need to go. One, of course, is a lot more expensive than the other. One is flashier and more fun to talk about at parties. But let’s be realistic. For most successful people, after your first job your future employers are less interested in where you went to college and more interested in what you have achieved in your working career.

When I started my accounting career at a large international public accounting firm, everyone in the “start group” had the same starting salary. It didn’t matter if you went to a state college or a private college. They were looking for a high GPA and other achievements. They were looking for the right candidates. I know this can vary for some companies who do have preferred schools, but for most it will not trump your credentials and achievements.

If you are dead set on a more expensive private school you will be at a disadvantage in getting through with little or no debt, as the cost could be double that of a quality state college.

Being Intentional is the Key

The most important factor of minimizing or avoiding college debt altogether, in my opinion, is to be intentional about the financial aspects of college as early as possible. Ideally, when your children are young, you should come up with a plan. Even if your plan does not work entirely as expected, you will be much further ahead when college arrives than someone that starts much later and without a plan. If you wait until your student is in high school to get started, you will be at a significant disadvantage. Regardless of when you start, doing something is always better than doing nothing. If your child is ten years old and you’ve done nothing to this point, get started now!

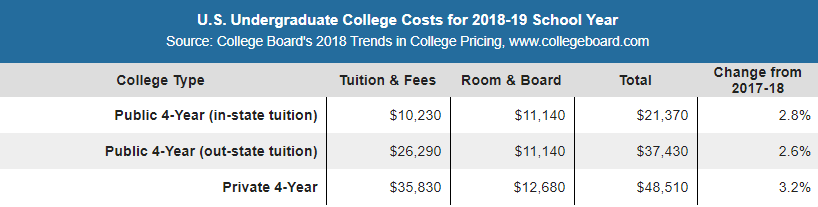

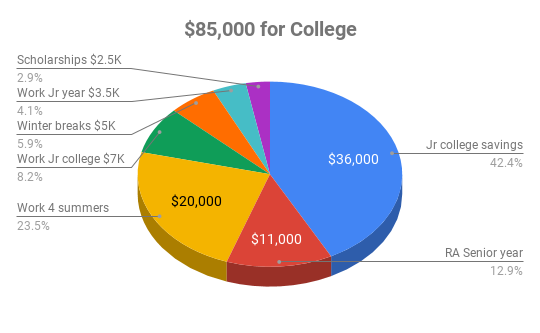

Example 1 – Paying for college without any savings

As shown in the chart above, a quality “in state” college today will cost about $85,000 over four years ($21,370 x 4 years). If a 529 college savings plan is not an option because you are out of time to save or the funds just aren’t available, here is one way to attack imminent college costs.

Action Items

1. After completing high school, continue to live at home the next two years and go to a local community college. You save a lot of money in both tuition in addition to free room and board by living at home. This allows you to get your general education requirements out of the way and then transfer to a traditional four year in state college to complete your degree after two years. Tuition and fees at a community college are about 1/3 of the cost of a four year state school (savings $36,000 in tuition, fees, room and board over two years compared to the four year college).

2. Work part time during the semesters while in junior college, earning $7,000 during those two years ($3,500 x 2 years).

3. Work full time all four summers before each year of college, earning $20,000 over four years ($5,000 x 4 years).

4. Apply for Scholarships diligently and earn at least $2,500 for college. See the scholarship section later in this article to find lots of scholarship choices.

5. Work part time during the semesters of your junior year at college and earn $3,500.

6. Work full time during each of your winter breaks. This could be seasonal work around the holidays or more hours with your existing part time employer or summer employers. You can earn $5,000 over four years doing this ($1,250 x 4 years).

7. At the four year college you become an RA (Residence Assistant) for your senior year, getting one year of free room and board for that service (saving approximately $11,000 in room and board).

Action Items to Consider in Advance of College

529 College Savings Plans

Open a 529 college savings plan when your child is very young. You pick the pace and amount. The key is to start early and invest regularly so you can let the power of compounding do the work For example, if you invest $50 a week ($10 per work day) after your child is born and put it in an S&P 500 or similar low cost equity index fund, and continue that monthly investment pace until the start of college (18 years), you would have invested $46,800 for college. With earnings and compounding you could expect a balance available for college of at least $80,000.

In today’s dollars that will just about pay for four years of college at a quality state school. Many people easily spend $10 per work day on lunch and Starbucks, so it’s not out of reason for most people to save $10 per work day for college. The best part of the 529 plan is that the earnings are tax free if you use it for qualified higher education costs.

Many states give you tax deductions for investing in 529 plans

In addition, many states give you a tax deduction for investing in a 529 plan each year. In our example, you would invest $2,600 a year for college. If a state has a 5% tax rate you would also save $130 per year in state income taxes for each of the 18 years.

529 Plans have flexibility

If for some reason your child does not go to college you can change the beneficiary of the 529 plan to another student. That student could be another child, grandchild or even yourself! Also, if your child earns scholarships for college you are allowed to withdraw that equal value from the 529 plan without penalty. This is so that you are not punished if your child gets scholarships for college and the 529 money is not needed.

Before you decide that $10 per work day is out of reach, I challenge you to look closer at all your spending to see where you can make changes to free up additional funds. Do you have too much house or too much car? What about discretionary spending? Can you make some adjustments there to free up some money? Obviously if you have more kids this becomes more difficult. Keep in mind that a 529 Plan is just one tool to save for college. As presented in the first example above, your student can get through college debt free without a college savings fund.

529 Plan resources

For more information on 529 College savings plans check out Clark Howard’s site. He and his team do a fantastic job breaking down the best 529 plans in the country.

If you are interested in savings estimates please click here for a College savings calculator you can use to run your own scenarios.

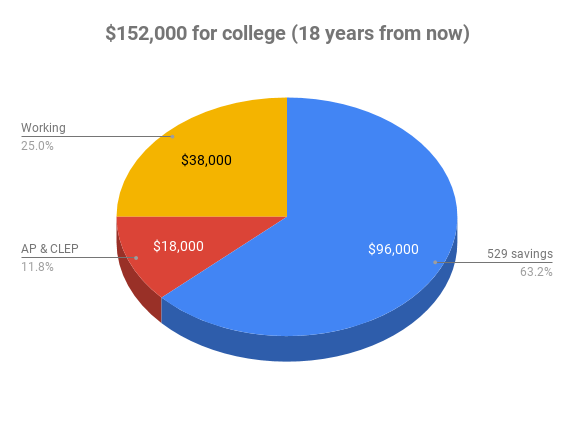

Example 2: Time on your side before college. How to use these tools to cover a four year degree at an “in state” college estimated to be $152,000 (18 years from now)

As shown earlier, the cost of four years of college at a quality in state school is approximately $85,000 today ($21,300 per year over four years). However, the other problem is the increasing cost of college. Over the last 10 years the average annual increase is about 4.8%. In the recent year it was closer to 3%. This rate of increase can have a huge impact on the expected cost of college in 18 years. For example, using a 4.8% annual increase, the cost of college would increase from $85,000 today to $214,000 18 years from now. At 3% it would be $152,000 in 18 years. College debt is a huge issue today so there will definitely be pressure and a spotlight on colleges to reduce the pace of increases in the future. Let’s use 3% as the annual increase of college expenses assumption for these calculations.

Action items

1. Put $250 per month (about $60 per week or $12 per work day) into a 529 college savings fund after your child is born up until age 18. The fund starts out more aggressive in equities when they are young and becomes more conservative as they get closer to college. A target date fund with the year of college is another good choice. The target date fund will handle the asset allocation automatically (you want to be more conservatively invested the closer you get to your target date of college). If you do this and average a 6% return annually you can expect to have up to $96,000 tax free for college 18 years from now.

2. Your child takes nine credits of AP classes while in high school (value 18 years from now = $10,800)

3. You child uses CLEP tests in college for another 6 credits (value 18 years from now = $7,200)

4. Your student works 10 hours per week during the college semesters and full time in the summers while not in school (value $38,000 using estimated wage rates 18 years from now).

In this example you have the four years of college expenses (estimated at 18 years from now at $152,000) covered with a combination of 529 savings, working during college and reaping the savings from taking some AP classes in high school and CLEP tests in college.

Other Options to Save for College

Roth IRA

Another secondary option or backup plan to consider would be a Roth IRA. If you qualify to contribute to a Roth IRA you could put money there each year. The Roth is indented to be for your retirement. However, the Roth is flexible enough that you can withdrawal your principal contributions (or a portion thereof) at any time without any penalty. So, in our example, if you had $46,000 in contributions over the years you could withdraw those at any time without tax or penalty (just not the earnings).

Keep in mind, however, that you can’t withdraw the earnings until you meet the retirement age requirements. The Roth does give you the flexibility to use this as a backup for college but be aware that your retirement is probably more critical that you child’s college (as they have many more earning years ahead of them), so you don’t want to be in a position to choose their college over your retirement. For most the 529 plan is the best option if the probability is high that your child will go to college.

Advanced concept – Use Real Estate to Pay for College

For real estate investors, one approach is to make a down payment to buy a rental property by the time your child is three years old. You take out a 15 year mortgage on the rental property and let the rental income from tenants pay off the mortgage for you over the next 15 years, which is the age your child will be ready for college. You then have a paid off property that you can either sell and use to pay for college or borrow against the property to pay for college (and use the income from the rental property to pay off the new mortgage).

Real Estate Example

For example, you put $20,000 down on a $100,000 rental property, thereby borrowing $80,000. You take out a 15 year mortgage and you have a $100,000 free and clear property when your child enters college. That would be conservative too, as real estate would likely appreciate in value over the 15 years so it will likely have a much higher value than your original purchase price. For example, if the property increased in value just 2% per year over the 15 years you would have a mortgage free property worth approximately $135,000 on an initial investment of $20,000. Not too shabby for a college savings plan!

Now – Focusing on the Student:

AP Classes

Take some AP classes while in high school and earn college credit. This will save you both time and money in college. You can reasonably earn six to twelve college credits taking AP classes in high school (some have done much more but this is a reasonable goal). An AP exam costs about $100. That is significantly lower than college credits. AP classes are one of the best deals! See your high school administrative office to see what AP classes are offered.

Scholarships

Scholarships are out there. It is often a numbers game. The more you apply for the more you will get. Some sites to search for scholarships include: unigo.com, goodcall.com, and scholarships.com. Also myscholly.com has a relatively inexpensive monthly subscription service that allows you to get lots of matching scholarships. Also try collegeconfidential.com.

The Evans scholarship is also a fantastic scholarship. You qualify by being a golf caddie for two years while being in high school. If you qualify after going through a series of interviews you can get a full ride to a university (you get free tuition and free room and board by staying at an Evans Scholarship house). I had an intern that worked for me that was an Evans scholarship recipient. I was blown away when he described free tuition, room and board at a prominent Big Ten state college. This is one of the best scholarships I’ve ever heard of! For more information go to the Evans Scholars Foundation Site.

While in College:

CLEP Exams

CLEP exams are another great way to earn college credit at a reduced cost. At https://clep.collegeboard.org/ you can check which CLEP exams are accepted by your college. For less than $100 you can take a CLEP exam and test out of a college class. CLEP does not impact your GPA. You just get credit if you pass. No impact if you don’t. If you don’t pass the test there is a waiting period but then you can take the test again.

Become a Resident Assistant

Consider becoming an RA (Resident Assistant) in the college dorms for one year or more and get free housing, free food and more for those years at most colleges. You are essentially getting paid with room and board to perform the RA function. What a deal to help pay for college! You also develop leadership skills that you can put on your resume and use for your future career. If you are considering this as an option please see this article regarding Residence Assistants so you can evaluate the pros and cons.

Additional Ways to Pay for College

Some have joined the ROTC in college as another way to get education assistance. This is a commitment so weigh your options here carefully. This is just another tool to consider. Learn more at todaysmilitary.com/training/rotc

Working while in college

You should also consider working a part time job while in college and full time in the summers if you are not taking classes. You should be able to work 10-15 hours per week during your college semesters without having any impact on your grades. For many having a part time job while in college will help your resume, get you additional money for college, make more friends and improve your skills.

Working in college helps you develop real world skills

Another benefit of your college student working during their college years is to learn how to manage money. For example, our kids pay for their food at college and also their books. Buying their own food using money they earn allows them to manage the daily and weekly spending decisions of what is a good value and what is not. They have “skin in the game” for college and also develop valuable skills on how to manage a bank account to pay for things. It also teaches them to learn their spending rate and earning rate so they develop the skill of understanding the pace of spending money within their limits.

These skills are invaluable to learn while young, as many young adults take a huge step backwards financially by running up balances on credit cards (in addition to student loans) early in their career and then spend years trying to pay it off. Our kids use debit cards in college to manage their spending. Any excess is moved to a savings account and transferred to the online checking account as needed.

Tuition reimbursement

Many medium and large companies offer tuition reimbursement for some or all of your education. One approach is to be working before completing your undergraduate or graduate degree and see if your company can help you pay for it by utilizing their tuition reimbursement program.

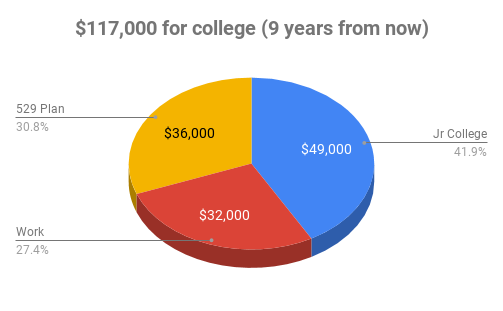

Example 3: Starting later at the half way point – only nine years left before college (student age 9) – college estimated to be $117,000 nine years from now.

In nine years a quality “in state” college is expected to cost approximately $117,000 (assuming 3% annual increase in expenses). Here is a plan to minimize or eliminate student debt under this circumstance.

Action items

1. Parents put $250 per month in a 529 savings plan starting at age nine. This will provide approximately $36,000 for college by age 18 assuming a 6% return in a low cost target date index fund.

2. After completing high school, continue to live at home the first two years of school and go to a local community college. You save a lot of money in both tuition in addition to room and board by living at home. This allows you to get your general education requirements out of the way and then transfer to a traditional four year college to complete your degree. Tuition and fees at a community college are about 1/3 of the cost of a four year state school (savings $49,000 in tuition, fees, room and board over two years nine years from now).

3. Work full time during your summer months and part time during all four years of school (earning $32,000 over four years nine years from now).

As you can see from these examples and techniques, there are a number of different tools to eliminate or drastically reduce the amount of student loans. A number of other methods described in this article (real estate, ROTC, Roth IRA, tuition reimbursement) were not even included in the three examples.

There is no right or wrong way to use these tools. You can use some of them or all of them! Put together the pieces that work for you and solve the puzzle. Being intentional and putting in some effort will make a massive difference in having little or no debt.

Executing even some of these concepts can have a huge impact on your financial future. Starting off with a degree and little or no debt is a significant advantage compared to someone with tens of thousands (or more) of student loan debt. That hole often takes years and sometimes decades to pay off. By taking steps early and being intentional you can win at the student loan game!

More content to consider:

I really like the idea of using an investment property to fund your child’s college tuition. Now I just need to find a nice duplex that will cashflow with a 15 year mortgage….