IF YOU JUST WANT THE SPREADSHEET CLICK HERE AND SEND US A QUICK MESSAGE TO REQUEST IT. ——->BUDGET TOOL

WE WILL SEND IT TO YOU WITHIN 24 HOURS

Understanding is the first Step

Are you paycheck to paycheck or close to it? Do you get stressed out over money all the time? Are you sick and tired of it? Getting a clearer picture of your finances (good or bad) is the first step toward getting better control of your money.

A Simple Worksheet Tells you a lot

A spreadsheet is a good visual tool to allow you to step back and see the big picture of your financial situation. It allows you to see on a couple sheets of paper what income, taxes, savings and expenses round out your monthly and annual finances. At this stage it doesn’t matter if the results are good or bad, but rather that they are reasonably accurate.

In order to create the picture, you may need to look at your bills and pay statements for a few months. If you don’t have all the information you need you can go with estimates to get the process going. You can always update your worksheet with more exact information as it becomes available.

Look for “Aha” items

Chances are that after you draft up your worksheet you may be surprised by some of the numbers you see. Maybe you are spending a lot more in a category than you expected. Where is most of your money going? Did you know that before? Hopefully this exercise gives you better clarity of your money. With that clarity you can make informed decisions to improve things going forward.

Take some action now

Do you see any low hanging fruit? In other words, are there obvious areas where you can make some changes and get to a more favorable monthly cash flow? If so, start cutting back in areas where you are overspending, or stop spending money for services or subscriptions that don’t give you any value. In many cases people have subscriptions they are paying for each month but are no longer using.

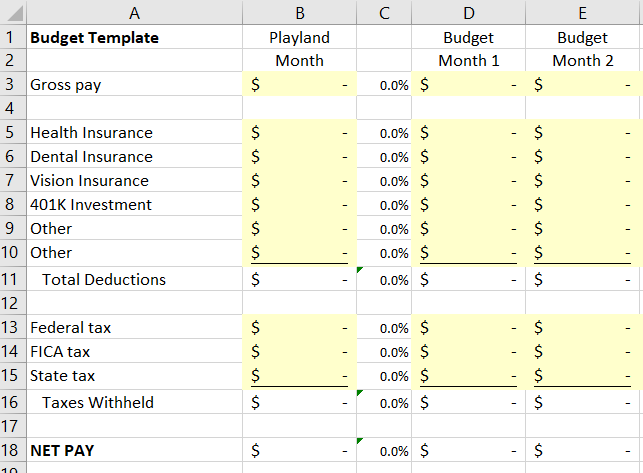

Worksheet preview

Here is an image of the net pay part of the worksheet. This includes your gross income, deductions and tax withholding to get to your net take home pay. It doesn’t matter if you are paid weekly, bi-weekly or semi-monthly. Take a typical paycheck or two and annualize it and then divide by twelve to get your monthly income. For example, if you are paid $1,000 per week, multiply it by 52 to get your annual gross pay. Then divide that number by 12 to get your monthly gross pay. In this example $1,000 x 52 = $52,000 / 12 = $4,333 per month. You can do the same with your deductions and tax withholding. It’s even easier if you have your last pay statement for the year. You can divide the year to date number by 12 to get the monthly amounts.

The “playland” column is not part of your official projection. This column is a good tool to try different scenarios to see how the numbers look.

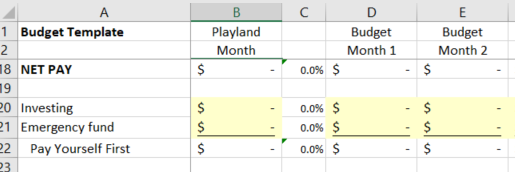

Pay Yourself First

In order to get ahead, you have to treat yourself like the most important bill you have. This financial planning worksheet has a place for you to put money aside for your future and emergency fund. Years from now you will be glad that you put this first rather than last. You need to figure out how to live on what is left after you pay yourself. Human nature is to pay yourself last, with the leftover money. The problem is that there is almost no money left over. You must plan it and make it happen!

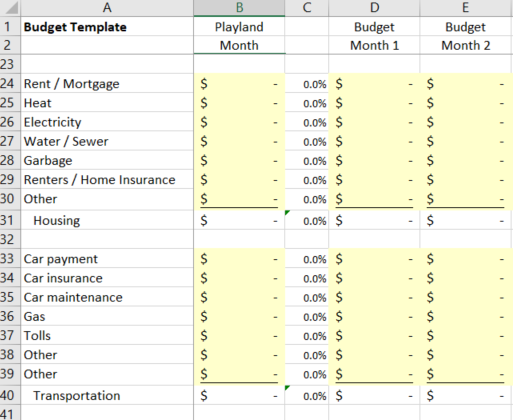

Housing & Transportation

For most people housing and transportation are the largest expenses. If you can keep these costs under control the rest of your financial life will likely be much better. These two categories combined usually account for 50% of your expenses, with housing typically at around 35% and transportation at 15%. There is no magic number, but these are big categories so the worksheet breaks them out separately so you can clearly see them.

Wrapping things up

The last section of the worksheet is for all your other expenses. There are lots of potential categories so we’ve put many placeholders in so that you can write in your specific category. Every category is also presented as a percentage of your gross pay. This is a good way to see where most of your money is going.

In Summary, completing and periodically updating your projection worksheet has many benefits:

- Better clarity on your overall monthly and annual cash flow

- “Aha” moments to give you areas to take immediate action

- Reminder to pay yourself first to ensure saving is your highest priority

- Gives you categories to focus on

Get the Worksheet for free

You can get the worksheet for free by emailing us via our contact page and requesting the worksheet: https://www.smartmoneytoolbox.com/contact/

Related Articles: