A car is a lifestyle choice and a significant financial decision

When I was a child I remember my dad always saying “A car keeps you poor” and a “car is a hole in the ground in which your pour money.” These words ring as true today as they did back then.

The reality is that cars are quite expensive when you add everything up. The typical car loses value each month while their owners pay interest on top of a loan to pay for them.

Some people are really into cars as an extension of their personality. Others see it as just a mode of transportation to get from point A to point B. Regardless, having a clear financial picture will help you make an informed choice. You don’t want to find out later you made a big mistake!

One way to simplify the math is to take the expected cost of the car and divide it over the period of time you plan to own it. Once you have the cost per year you can compare options to see what is the best choice for your finances.

New vs Used cost example

It has often been said that buying a two year old used car with low mileage (under 30,000 miles) is a better financial move than buying a new car. I decided to run the numbers myself to see the difference.

Reasonable facts to use for the comparison:

- New car for $30,000 with a $3,000 down payment and a loan for $27,000 at a 4.5% interest owned for 8 years vs

- Same car bought as a two year old used car for $19,380 (2 year depreciated value) also with a $3,000 down payment and a loan for $16,380 at 7.5% owned 8 years

- Both cars driven 12,500 miles per year on average.

- A 5 year car loan is used in both examples. The new car has a 3% better interest rate than the used car. Using the purchase price and rates above the new car has a $503 monthly payment and the used car has a $328 monthly payment.

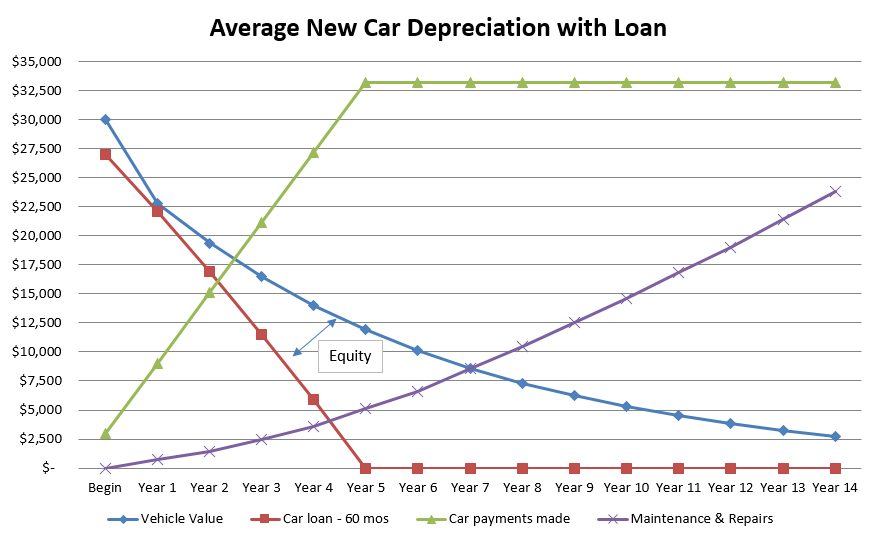

New Car numbers

The above chart shows the cost of the average new $30,000 car. By average I mean it’s loss in value, or depreciation curve (blue line), is in the mid range of vehicles. As with almost any new car, the value drops significantly the first two years (about 35% or $10,600 in this example) and then another $9,300 over the next four years. After eight years and 100,000 miles it is worth about $7,300 (after losing $22,700 to depreciation).

With your $3,000 down payment you start off with $3,000 in equity in the new car. Unfortunately, that only lasts briefly. By the end of the first year your equity drops to about $700 even after making $9,000 in car payments ($3,000 down plus $6,000 in monthly payments).

Since your loan paydown is at a faster rate than the vehicle loss in value your equity grows to a maximum amount of $11,900 at the end of year 5 (gap between the blue line vehicle value and the red line outstanding loan balance) and then back down to the $7,300 residual value mentioned above at the end of year 8.

Maintenance and repair costs start out lower at about $700 per year early on and then up to about $2,000 per year by year 8. The purple line shows the increase in maintenance costs over time as the vehicle ages and has more miles driven.

In summary, after eight years you would have paid $33,200 in car payments (including the down payment) and $10,500 in maintenance and repairs for a total of $43,700 out of pocket. At the end of eight years the vehicle would be worth approximately $7,300. Your total cost is $36,400 over eight years ($43,700 – $7,300). If you divide $36,400 by the eight years of ownership your average annual cost is $4,550 to own and maintain your vehicle.

This of course does not include gas, insurance, registration fees, property taxes (if applicable) or tolls. You can add those on top of this number if you want a complete annual cost of transportation.

Used car numbers

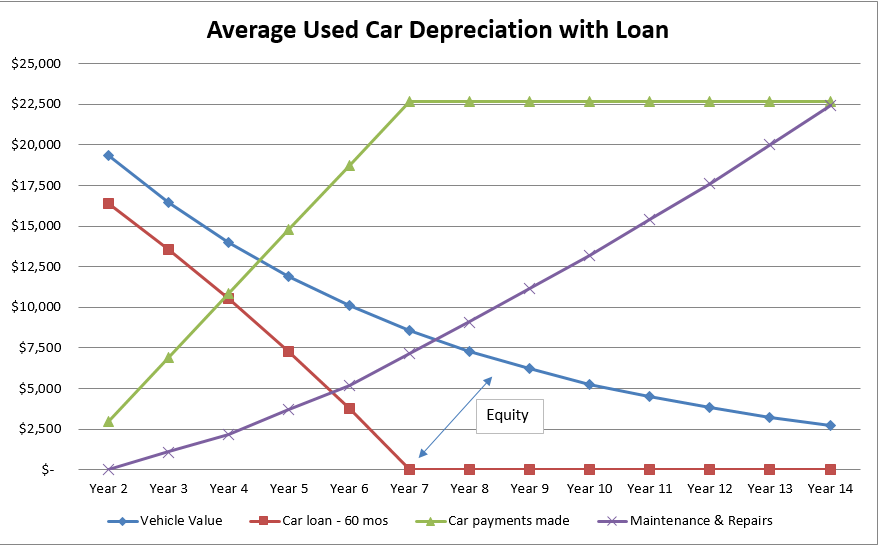

In this example you buy the same car except at two years old rather than new. At that point the value has depreciated to $19,380, your purchase price. This is more than $10,000 less than the new car at $30,000.

Using the same $3,000 down payment you would finance the remaining $16,380 over 5 years at an interest rate of 7.5%. Your monthly car payment would be $328.

As with any vehicle, the value continues to decline throughout your eight years of ownership. Your maximum equity is about $8,600 (difference between the blue value line and the red loan balance) after 5 years of ownership (vehicle is 7 years old). In this case the overall value drops from $19,380 at the time of purchase to $5,300 at the end of your 8 years of ownership (vehicle is 10 years old with 125,000 miles).

Maintenance and repair costs start out lower at about $1,100 per year early on and then up to about $2,000 per year by year 8 of ownership. The purple line shows the increase in maintenance costs over time as the vehicle ages and has more miles driven.

In summary, after eight years you would have paid $22,700 in car payments (including the down payment) and $13,200 in maintenance and repairs for a total of $35,900 out of pocket. At the end of eight years the vehicle would be worth approximately $5,300. Your total cost is $30,600 over eight years ($35,900 – $5,300). If you divide $30,600 by the eight years of ownership your average annual cost is $3,825 to own and maintain your vehicle.

New vs Used – conclusion

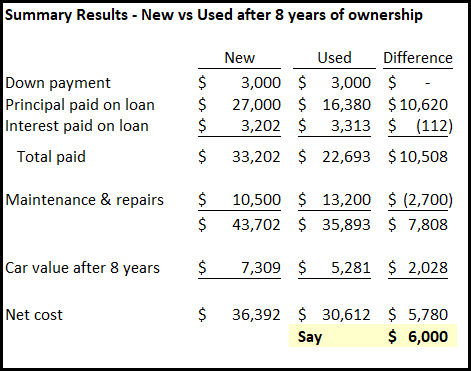

After eight years of ownership you would pay about $10,500 more in payments for the new car, primarily due to the higher purchase price. Conversely for a new car, you would save $2,700 in maintenance costs and have a higher residual value by $2,000 due to the car being two years younger after 8 years of ownership. The net is a higher overall cost of $5,800 over the eight years for the new car ($10,500 – $2,700 – $2,000). In round numbers let’s call it $6,000.

So, in this average example the new car will cost you $6,000 more than the used car for 8 years of ownership. The way I look at it, you are paying about $6,000 more to drive a newer car for two years. After two years it is the same car so there is no difference after that.

To step back and put this in perspective, if you bought 8 cars over your lifetime of driving and owned each one for 8 years you would spend roughly $48,000 more to buy new than used.

Let’s say you decide to buy used and instead invest the $750 per year that you would save vs buying new. You invest in a well diversified index fund that can conservatively earn 6% per year. Starting with your first car and continuing through the 64 years of car ownership you would have over $500,000!

This gets back to the lifestyle choice question. Is it worth it for you to drive a newer car for two years for $6,000 more, or would you rather use that $6,000 for something else? That is a personal decision that everyone needs to make on their own. Now that you know the answer, you can make an informed decision.

Please keep in mind that this is an average car example to prove out the math. Note that some car brands and models are much more reliable than others. By doing your research up front you improve the probability dramatically by getting a reliable vehicle (new or used). Tools such as the auto buying guide at Consumer Reports or hard copy from your local library can be used to see how cars rate against others for value and reliability. You obviously want to make sure you are not buying a maintenance heavy vehicle if you are trying to keep your costs down.

As you know $30,000 is on the low end of new cars these days. If you are buying more expensive cars and SUVs your savings will likely be even greater as an approximately 1/3 depreciation loss in two years is much more substantial in raw dollars at higher prices.

To keep things simple you can use the following guideline to get you in the ballpark. As you recall the additional cost of the new car was about $6,000 on a $30,000 purchase, or 20% of the new car price. You can use this 20% general rule of thumb to rough out the numbers for the average vehicle. For example, the reasonable expected difference for a $40,000 new car vs a two year old used would be $8,000 (20% x $40,000).

Also note that if buying used I recommend purchasing from a reputable company such as Carmax or Carvana with a very fair return policy to ensure you are happy with the purchase and get a quality vehicle. Regardless of where you purchase, be sure to get the car inspected by your mechanic before you sign the contract or before the return period ends to make sure there are no hidden issues before the transaction is final.

Related pages and articles:

Reduce your auto insurance premiums

Ways to keep car repairs under control

Sources: