Mortgage Loans

It is sad that we are all culturally conditioned to get the biggest house that we can “afford.” And by “afford” we are talking about affording “the monthly payments” (not really being able to afford the house). If you take this too far and borrow too much you can end up being “house poor.” What that means is that your payments for your home are so significant to your own financial situation that you don’t have enough money left over for other needs and obligations. Just because someone will give you a loan doesn’t mean it works for you. It is critical that you look at the payment compared to your other monthly obligations to make sure it fits into your budget without creating an undue hardship on you.

It is sad that we are all culturally conditioned to get the biggest house that we can “afford.” And by “afford” we are talking about affording “the monthly payments” (not really being able to afford the house). If you take this too far and borrow too much you can end up being “house poor.” What that means is that your payments for your home are so significant to your own financial situation that you don’t have enough money left over for other needs and obligations. Just because someone will give you a loan doesn’t mean it works for you. It is critical that you look at the payment compared to your other monthly obligations to make sure it fits into your budget without creating an undue hardship on you.

If you can do a 15 year mortgage rather than a 30 year without creating an undue hardship you may want to consider it. Becoming mortgage debt free 15 years earlier can be a tremendous advantage to your financial future. Another option is to take the 30 year mortgage but make additional principal payments that gets you on a 15 year pace. If you are going to do this you need to be really disciplined or put it on an automatic payment, as it will be too tempting to skip some months when you would rather spend the money on something else. The one advantage of paying down a 30 year mortgage at a 15 year pace is that if a financial crisis ensues, you are only obligated for the 30 year payment (instead of being obligated to a much larger 15 year payment). In other words, you would have more financial headroom in case of a financial crisis.

I’m not a big fan of an interest only mortgage, as you are making no financial headway (you are just paying interest). Often people do this so they can “afford” a house that is out of reach financially with a traditional mortgage. I see this really as renting rather than owning since you are just making payments to live there but not making equity progress from a payment perspective. Some have done this in markets that are expected to have significant price appreciation, making a play to make a profit from the equity gain while paying as little as possible. This is somewhat of a risk (leverage cuts both ways).

I’m also not a big fan of a mortgage over 30 years. In my opinion, if you need to take out a mortgage that long in order to afford the payments, you are probably buying too much house.

Another cost of a mortgage loan that you want to avoid is PMI. PMI = Private mortgage insurance. This is generally required for anyone that puts down less than 20% of the purchase price of a home. This can add a significant amount to your monthly payment. This insurance is for the lender (in case you can’t make the payments) but you pay for it. The only way to get out of this is to put down at least 20% or request that it be dropped once your home value increases and your equity position gets you to 20%. Check with your lender to find out how this process works (what proof do they need). In many cases you will need to pay for an appraisal to prove that you have the 20% equity.

Related Article: Stop Paying PMI

Legit Ukraine Donation Sites

There is a humanitarian crisis in Ukraine due to the invasion against their country. There is a tremendous need for food, medicine and other support. If you want to donate to support the citizens of Ukraine, please make sure you find a legitimate organization. During...

Personal Financial Check-up

We have recently added a new tool for the toolbox! This is a personal financial check-up scorecard. By providing some financial highlights you get an instant report of your financial situation. How cool is that! Here is the page link which is also a menu option at the...

5 Reasons to File your Tax Return Early

Another income tax season is upon us again! Here are 5 Reasons why you benefit by filing your tax return early. Five Reasons to File your Tax Return Early Reason 1 - you'll get your refund quicker. If you are due a refund and file electronically, you'll get your money...

Buy Now – Pay Later is a Bad Deal for You!

Buying something now and paying later is not a good move for your finances, especially for retail purchases. Let's talk this through by understanding the other side of the equation. Businesses are trying to survive financially just like you Businesses don't have to...

Is Slow Service the New Normal?

Ever since the Covid-19 pandemic started and the economic shock that ensued, there appears to be a continuing theme when it comes to service compared to before the pandemic. It' been 18 months since the start of it and now I'm beginning to question "Is Slow Service...

“You Can’t Eat Your House”

With the recent run up in home prices I thought it would be appropriate to bring up the old time saying "You can't eat your house!" What is going on, anyway There are likely lots of factors driving home prices up double digit percentages from the prior year. In it's...

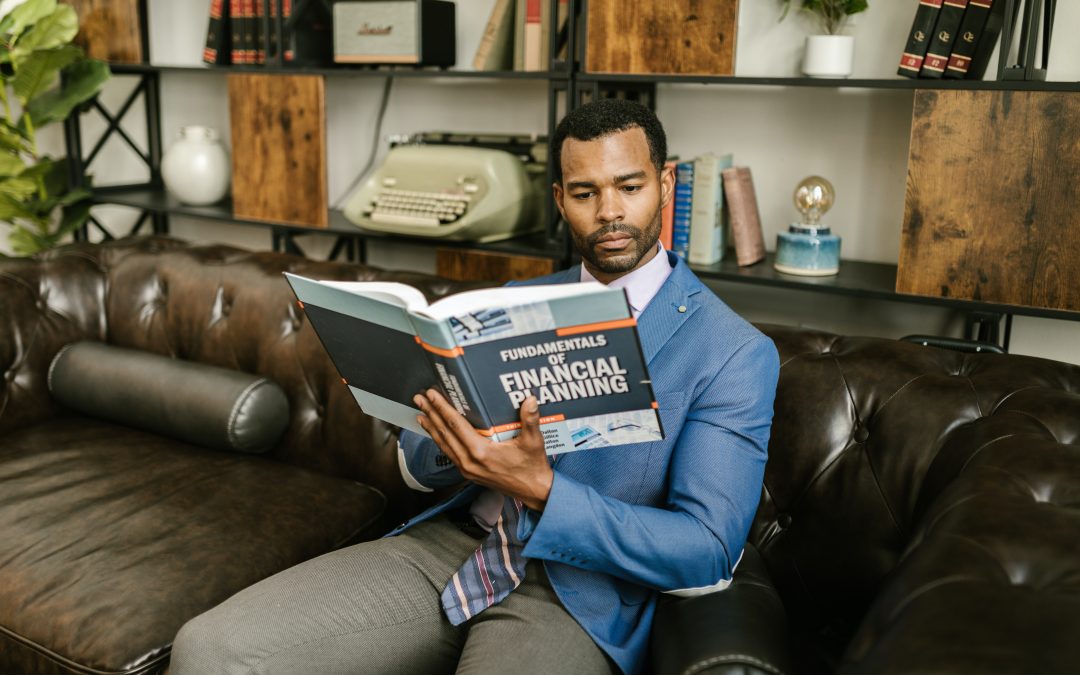

Atomic Habits and the benefits for your finances

I recently finished the book Atomic Habits by James Clear so I thought it would be appropriate to apply the salient points to personal finances as there are some good gems in this book. If you have not read this book it is worth it. The first chapter is nothing like I...

Why I’m Unhappy when all my Investments go up

Sounds crazy at first when you read this, but I'll explain. Sometimes we can't see the forest for the trees As investors we are wired to optimize our investment performance. We also hate losing money. In my opinion this leads us DIY investors and most financial...

How far above or below water are you financially?

As mentioned in our Principles section, our Golden rule of personal finance is to live beneath your means. In other words, if on average you are spending less than you are earning, you are making progress! If you were to follow just one tenet of personal finance, this...

Lifestyle Inflation – the Hidden Financial Killer

We’ve all been there. You start to make more money. Then you start to spend more money. Life feels more fun and you begin to loosen up the spending reins. You start to be less precise with saving and spending as you have this added cushion. It...