Per IRS rules, you pay taxes on stock gains when you sell (realized gain). If your stock went up in price and you didn’t sell (unrealized gain), then you don’t have any federal tax to pay on the stock price appreciation.

However, holding a stock can still generate taxes, even if you don’t sell. For example, if the stock you own pays a dividend, you will receive a 1099-DIV at the end of the year and you will likely have taxes to pay on the dividend income.

The type of account where you hold the stock investment also has a big impact on taxes. For example, if you hold the stock in a retirement account (tax advantaged), you won’t pay any taxes for selling your stock.

It is also common for people to hold mutual funds in addition to individual stocks. These funds may generate taxable capital gains distributions each tax season by just holding the investment.

Let’s break this all down with a few visuals to cover all the bases.

Investment Account Types

A brief discussion regarding account types may help clarify the tax picture. There are lots of account types available, but the main delineation would be taxable vs tax advantaged retirement accounts

A taxable account is a normal brokerage account that is held personally by you. It is not much different than a bank account in your name that holds cash, except in this case it is an investment account in your name that holds stocks and other investments. Typically this account would be with a brokerage firm such as Charles Schwab, Fidelity Investments, Vanguard, Interactive Brokers, and others.

A retirement account is an account also in your name, but is legally designated as an Individual Retirement Account (IRA) or a plan sponsored retirement account such as a 401(K). When you hold your investments in these types of accounts, you are abiding by different tax laws than the standard taxable brokerage account.

Taxable Account

The chart below with the dotted lines, is a typical taxable brokerage account where you can hold stocks and other investments.

The line is dotted to signify no tax protection. In other words, any realized transactions (selling stocks; receiving dividends) in the account will trigger tax reporting.

If you buy and hold a stock (don’t sell it), you won’t have any tax to pay on the stock price appreciation. In order to trigger taxes you have to realize the gain by selling it.

Taking cash out of the Taxable account does not trigger any tax. Think of it as just moving cash from one place (your brokerage account) to another place (your bank account).

Retirement Accounts

With retirement accounts (also called tax-advantaged accounts), you have legally designated the account as holding investments for retirement purposes.

Being a retirement account, you get tax benefits. The trade-off is that by putting money in a retirement account, you must abide by the rules to get the tax breaks.

On the above graphic on the right, the solid lines signify that you can perform transactions within the retirement account and you won’t incur any taxes for doing so. In other words, you have tax protection by keeping the money in the retirement account.

With a retirement account, taxes are triggered when money leaves the account and goes to you personally. The logic here is that when you begin to take money out, you are in retirement. If it is a Traditional (“not special”) retirement account, the funds will be taxable as ordinary income (just like wages) when you receive them. If it is a Roth IRA or Roth 401K retirement account (“special tax treatment”), you will get the benefit of tax free withdrawals from the account.

The retirement account rules get pretty involved with a number of exceptions, which is beyond the scope of this article. I am providing the general framework on these account types.

Account types summary

Regarding stocks, no matter the account type, you won’t have any tax to pay on stock price appreciation if you don’t sell it.

If the stock is held in a taxable brokerage account, taxes will apply if you sell stock, or receive dividends or capital gains distributions.

In a retirement account, there is no tax to pay for selling stock or receiving dividends and capital gains distributions, as long as the funds remain in the retirement account.

Dividends in a Taxable Account

As mentioned previously, dividends received in a taxable account will trigger tax reporting. Just to clarify, it does not matter if the dividend stays in the account, gets issued to you directly, or gets reinvested (automatically via a dividend reinvestment plan or manually with you reinvesting the proceeds).

Think of it as two separate transactions. Receiving the dividend is the taxable event. You will get a 1099-DIV at the end of the tax year which will give you the amounts to report for your tax return.

What you do after you receive the dividend is a separate transaction. Reinvesting the dividend is buying another investment with a new purchase price and amount invested.

Capital Gains Taxes

When you sell a stock in a taxable account, it will trigger tax reporting. You will receive a 1099-B at the end of the tax year that will report the capital gain or capital loss. A capital gain is when the selling price of your stock is more than you paid for it, and a loss is when it is less.

The original price you paid for the stock is called your “cost basis.” The gain will be reported on the form 1099-B you receive as either short-term capital gain or a long-term capital gain. Losses are also reported as short-term or long-term.

Short-term capital gains or losses are for stock shares that were held for one year or less. Long-term capital gains or losses are for those held more than a year. The short vs long term distinction is important because the tax rates on gains are different depending on the classification.

Long-term capital gains rates are favorable compared to short term rates, so holding investments for more than a year before you sell can reduce the tax you pay.

It gets more involved when you have multiple transactions during the tax year of both long term and short term. You can net like items together. Long term losses offset Long term gains and short term losses offset short term gains. The end results are “net gains” or “net losses” for each type.

Ultimately if you have net capital losses you can reduce your taxable income in the current year depending on your filing status. You can deduct up to $3,000 of net capital losses against your ordinary income for a joint return or $1,500 for an individual return.

Tax-loss harvesting

You often hear or read about tax-loss harvesting. That is a process many people perform by the end of each year in a taxable account if they have capital gains they want to reduce.

With tax-loss harvesting, you are intentionally selling securities at a loss to offset those with gains to reduce you tax liability. This should be done carefully so as to not let the “tax tail wag the dog.” You would want to work with your financial advisor to understand if the tax-loss harvesting investment sale makes sense for your overall investment strategy in addition to the tax break.

Some would think you could sell an investment, take the loss against your taxes, and then buy it right back again. The IRS created the “wash sale” rules to prevent people from doing that. The rule basically disallows the loss for tax purposes if you buy the same stock back within 30 days. Some have somewhat managed around that by buying a relatively similar investment, just not the same one. Be sure to consult the rules and a tax expert to make sure your capital loss deduction qualifies.

Netting Capital gains and (losses) and the impact on taxable income

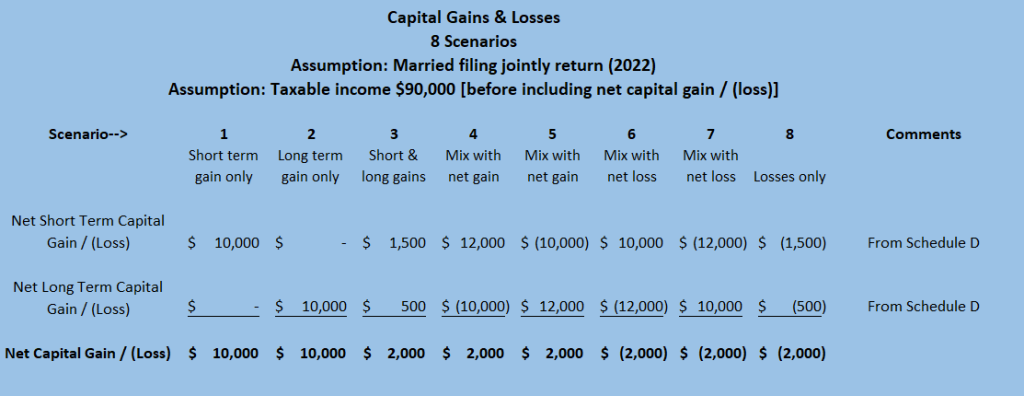

The netting of capital gains and losses gets a little involved. Below is a visual to give you a look at the dynamics going on.

Currently, long term capital gains have preferred tax rates as compared to short term gains, which are treated as ordinary income. That could always change with updates to the tax code.

The long term capital gains rates are 0%, 15% and 20%, depending on your taxable income. For 2022, a married couple would pay 0% on long term capital gains up to taxable income of $83,350. The next marginal rate is 15%, which is taxable income of $83,351 to $517,200. Above that is the 20% rate. For 2023, the capital gains income brackets will increase. You can read more about the capital gains rates on the IRS website.

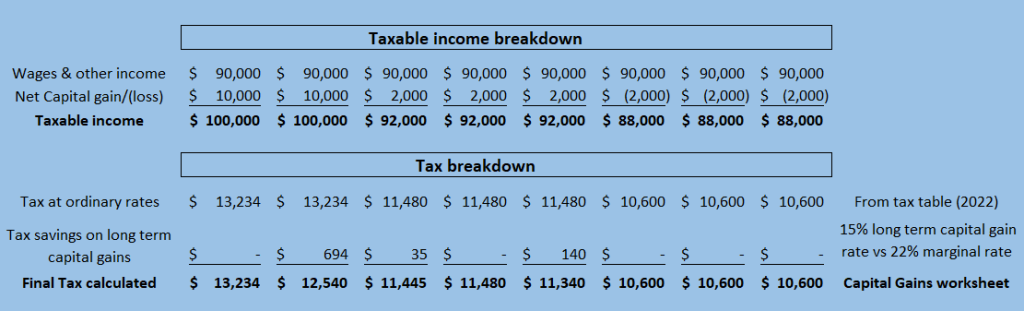

The visual below shows the tax for a married couple with $90,000 of wage income and then the capital gains or losses added to it. The combination of the wage income and the net capital gains or losses is the taxable income.

The capital gains worksheet for the tax form 1040 is used to calculate the tax rate savings for long term capital gains, if applicable. In other words, the gains go into taxable income at the ordinary tax rates and are adjusted back down in the tax calculation if there are long term capital gains rate benefits.

There are essentially eight scenarios with capital gains and losses, numbered 1 to 8 in the visual below. You can also have only short term capital losses or only long term capital losses. The result is the same as scenario 8, which has a combination of losses, so we are not showing those as separate scenarios.

Examples of Capital Gains and Loss netting

For scenarios 4 – 7, possibly due to intentional tax loss harvesting, large capital losses are used to offset large capital gains, reducing the net impact on taxable income to just $2,000 (plus or minus).

In scenarios 2, 3 and 5, you have an additional 7% tax rate savings on the eligible long term capital gains (15% long term capital gains rate vs 22% ordinary income tax rate).

Note that Scenario 5 has $2,000 of net capital gains, with the long term portion being $12,000. The rules say the eligible long term capital gains are the lower of the long term capital gains or the overall net capital gains, so your long term capital gains tax rate savings is limited to $140 ($2,000 x 7%).

Remember that in this example, the married couple has taxable income that puts their long term capital gains rate at 15%, which resulted in the 7% savings as compared to their marginal tax rate of 22%. If their income was much lower, their long term gains rate could be 0%, which would be an even larger savings compared to their marginal tax bracket.

Of course the big tax savings is in netting the capital losses against the gains, as you can see with scenarios 1 and 2 having much higher overall taxes due to the lack of capital losses to offset capital gains.

Investment types

So far we’ve primarily been discussing individual stocks. Other common investments held in a brokerage account would be mutual funds.

With a mutual fund you own shares in a fund that in turn holds lots of stocks or other investments. The same rules apply here as mentioned above. However, the fund will have it’s own realized transactions of buying and selling the holdings in the fund. Since you are a partial owner, those transactions will be taxable to you in the form of capital gains distributions. In other words, the fund had realized gains and those gains get passed to the owners.

Remember that the account type dictates if you pay tax or not on the capital gains distributions. In a retirement account, there is no tax to pay on these transactions as long as the funds remain in the retirement account. These distributions would add to taxable income for standard taxable brokerage accounts.

Executive Summary: Do I pay taxes on stocks even if I don’t sell them?

- If you don’t sell a stock, you won’t have any capital gains tax to pay

- However, you may still pay taxes if you receive dividends

- You may also have taxes due if you receive capital gains distributions on a mutual fund

- If your investment is in a retirement account, you won’t have any taxes as long as the funds stay in the retirement account

- When you sell an investment in a standard brokerage account, you may have capital gains tax to pay

- There is a process of separately netting long-term gains and short-term gains when preparing your tax return

- You can reduce the capital gains tax on an investment if you have offsetting losses

- The tax rates on long term capital gains are currently favorable compared to short term gains that are taxed at your ordinary income tax rate

The information provided in this article is for general information and educational purposes. There are lots of specifics and exceptions with the tax laws. Be sure to consult with your tax and investment advisor before making any tax or investment decisions so they can take into account your own personal circumstances. Make sure your financial advisor is a Fiduciary, which means they are legally obligated to do what is in your best interest, not theirs!

Articles to read:

- Are Financial Planning Advisor Fees Tax Deductible?

- Can I invest $20 in the Stock Market?

- Best small cap ETFs to compliment your equity portfolio

- Difference of a Fee-Only vs Fee-Based financial advisor

- Online Personal Financial Checkup

- Understanding the Difference of Revenue vs Cash Flow

- Do Trusts need a separate tax ID number?

- Fund Comparison: Vanguard VTSAX vs Fidelity FSKAX