If your investment objective is to hold the United States equity market as part of your investment portfolio, Small Cap index funds are likely an important piece to the puzzle.

If you hold mutual funds or Exchange-traded funds (“ETF”) as an investor, it makes sense to cover the entire equity market more thoroughly by holding the small companies in addition to the large ones. Most total stock market and S&P type funds are heavily weighted toward the large companies, which means they have a lot less coverage of the smaller companies.

That is where the small cap index ETFs come in. By balancing out the larger companies with smaller ones, you get much better market coverage. In addition, since these two types of holdings are slightly uncorrelated, you can get reduced volatility when you hold both.

Low Cost index ETFs

It seems obvious, and has been proven, that low cost index ETFS will outperform related investments at higher cost. That is because of the drag costs have on an investment portfolio. A 0.5% or 1% portfolio expense ratio doesn’t sound like a lot, but it can be massive over time! Paying higher fees can push out your retirement date a number of years.

If you buy a low cost fund at 0.03%, for example, you are saving 97 basis points (0.97%) compared to a 1% expense ratio portfolio. Once compounding kicks in, you will be left in the dust with a high cost portfolio.

Warren Buffett’s famous challenge to hedge fund managers helped prove the point that low fees and passive index investing are hard to beat by active managed funds.

Index ETFs should be low cost, because you are not paying a portfolio manager to make strategic investment decisions. The portfolio managers really only need to act in an administrative capacity, as they just need to ensure that the fund’s portfolio meets the foundation index that the investment is meant to replicate.

Why take on that additional cost if there are plenty of great choices that are low cost? It’s kind of like credit cards. Why get a high annual fee credit card when there are so many no fee cards that offer the same great cash back benefits?

Here are some resources that show the impact of fees over time on an investment portfolio for illustrative purposes:

Value vs Growth vs Blend

Within the small cap index ETFs, there are choices. Some are called value indexes, which means they hold companies that have good fundamental financial ratios (ie: price per earnings), meaning they can be bargain purchases.

Others are growth indexes, which means they hold growth stocks that are reinvesting heavily in the business which gives them higher growth potential. These companies are betting on growth to catapult the stock price over time. These stocks are more risky as these companies tend to have losses or inconsistent earnings while they invest heavily in growth and development.

The other option is to hold a small cap blend index ETF, which contains both value and growth companies. That is how it gets the “blend” name.

Best Complimentary Investments

If you are looking to hold small cap funds to balance out your large or total stock market holdings, it’s been shown using historical performance that Small Cap Value might provide the best balance. This is likely because small cap value is the most uncorrelated from Large Cap equities.

See portfolio visualizer for an example of returns and correlations comparing a total market index fund to small cap funds.

Of course past performance is no guarantee of future performance, but a long track record over time usually provides a higher level of confidence than otherwise.

Individual stocks vs index ETFs

The beauty of index ETFs is that they are normally low cost, which gives you an edge on compounding growth over time, as previously discussed.

Another big benefit is diversification. By owning an index you essentially remove the individual stock risk. In other words, if you own an individual stock and it goes to zero (Enron, Radio Schack, Blockbuster, etc), you lose your entire investment. In an index fund, the percentage of any one company is often quite small, which means a total loss of a single company should have a very small impact on the overall portfolio.

The other positive of an index ETF is that it is self cleansing. What I mean by that is if one of the companies is a winner, you get the benefit as it runs up in value. If another company is a loser, it drops off the index and is replaced by another company. So, you let the winners run and the losers get cut out. Also, if it is a big winner, it could move from Small Cap to Large Cap so you can enjoy the run up in value holding both indexes.

Definition of Large Cap, Mid-Cap and Small-Cap Equities

Basically, the investment community groups stocks based upon their total market value. This is also known as market capitalization. The market capitalization of a publicly traded company = Number of stock shares outstanding x market price per share. In other words, how much is the company worth on the open market. Of course, prices change every trading date, so the market capitalization is always different.

Market Capitalization =

Company Shares Outstanding x Market Price Per Share

The stocks are then ranked based on their market capitalization. The largest ones are called large-cap stocks. The medium sized ones are call mid-cap stocks, and the smallest stocks are called small-cap stocks.

Generally speaking the company market cap sizes that define the categories are as follows:

- Small Caps: $300 million – $2 billion

- Mid Caps: $2 billion – $10 billion

- Large Caps: $10 billion +

These acronyms sound fancy, but it’s merely grouping large, medium and small size companies. That all it is!

Small-Cap ETF Indexes

There are a number of different indexes that are the foundation for some of these Small-Cap ETF index funds. These are basically different groupings within the smaller public companies. Some of these indexes include:

- S&P small cap 600

- Russell 2000 Index

- CRSP US Small Cap Index

- Dow Jones U.S. Small-Cap Total Stock Market Index

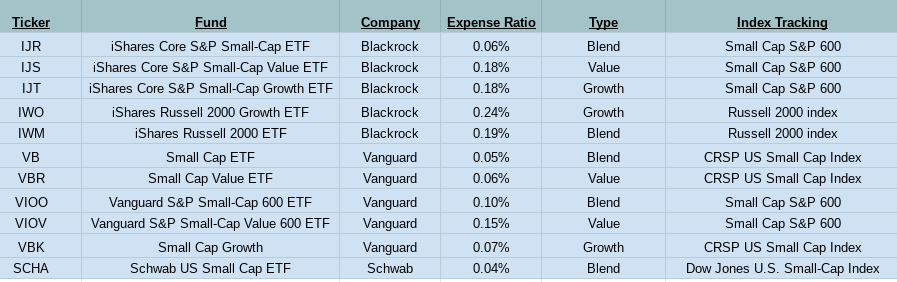

Vanguard, Fidelity and Schwab are the three large discount providers of index funds and ETFs. Any one of these companies would be a good choice to purchase your investments. IShares by Blackrock is another well known set of ETFs.

Due to no commission trading these days, using a discount brokerage such as TD Ameritrade, for example, would be another viable option.

Here is a list of some of the best ETFs in the small-cap funds space that have lower cost:

Correlation of investments

It likely does not pay to spend too much stressing out over which small cap index ETF to choose from. Their correlations are very similar, which means that they move up and down together a high percentage of time.

See this link for the correlations and returns for the small-cap ETFs discussed earlier as shown on the Portfolio Visualizer website.

Prospectus and Holdings

It’s important to take a look at the top holdings of the ETF you are considering purchasing. You can go online and see the latest holdings of any of these ETFs. This gives you a much better idea of what is in the index ETF you are evaluating.

Also be sure to review the fund’s prospectus document which breaks down the investment. Remember a good investment rule of thumb.

Don’t Invest in Anything you don’t understand

Summary: Best Small Cap index ETFs to Compliment your Equity portfolio

- Small Cap index ETFs can provide good balance to a large cap Equity portfolio

- Low cost ETFs will reduce performance drag which will have a significant favorable impact over time vs similar high cost funds

- You can choose from Value, Growth and Blend small cap Index ETFs

- Small Cap Value funds have been shown in the past to provide a good balance when combined with large cap equities

- Index funds offer diversification and self cleansing as advantages compared to individual stocks

- Small-cap, Mid-cap & Large-cap are just fancy terms for small, medium and large public companies

- Index funds usually have a common index as their foundation such as the S&P small cap 600, the Russell 2000, Dow Jones Small cap index, etc

- Since small-cap index funds are variations of the same population of stocks, they are correlated and often move in the same direction most of the time

- Take some time to review the prospectus and holdings to ensure you understand the ETF before investing. Never invest in anything you don’t understand!

Other Articles to Consider

- Which small-cap value fund is better: VSIAX or VBR?

- Do I have enough to Retire?

- How far above or below water are you financially?

- Best Fidelity Index Funds for a low cost portfolio

- Vanguard VTSAX vs VTI: How to choose between them

Disclaimer: Investments have a risk of loss. Always be sure to investigate numerous alternatives before putting money at risk. You are responsible for doing your own due diligence before investing any of your money. Your financial future is too important to wing it! Past performance is no guarantee of future results. Make sure that your financial advisor is a fiduciary, which means that they are obligated to do what’s in your best interest, not theirs!