What is an HSA

HSA stands for Health Savings Account. It is an account that you own and is designed for you to pay medical expenses now or in the future.

If you meet the requirements by being in a qualified high deductible health plan (HDHP) you are then able to put money in an HSA if you choose.

As of the writing of this article those that qualify can contribute up to $3,550 in an HSA for an individual plan or $7,100 for a family plan.

Different than a Flexible Spending account, that is “use it or lose it” for the year, an HSA allows you to carry forward any unused amounts to future years. In other words, you can grow a nest egg for your current and future medical expenses. How cool is that!

Choose Carefully

You do need to be careful that in a high deductible health plan that you have the financial means to handle the higher deductible should you have significant medical expenses in the current plan year.

For many, when you run the math, knowing that you or your family tend to have lower medical claims, the savings in lower premiums in a HDHP is worth the risk.

That is a personal decision so choose carefully. If in a given year you don’t need to spend your HSA contributions you will begin to build a nest egg that can grow over time.

Once Decided – take action!

When I first made the move a number of years ago I took the premium difference between what I would have been paying in a traditional plan and the new lower premiums in a high deductible plan and put that in an HSA account. In other words, my contributions related to both plans (HDHP and Traditional) would have been the same. The difference was that at the end of the year with the high deductible plan I also had an HSA account balance with my name on it and in the traditional plan I would have had nothing.

Many employers will also contribute money to your HSA to encourage you to choose a high deductible plan. This makes sense for the employer because if you choose the high deductible plan they will save on their portion of the health premiums too.

When you reach the point where the higher deductible is fully funded by the HSA account, you are ahead of the game. Once that happens you have hit the breakeven point and everything after that is gravy! Over the years your HSA account can grow into tens of thousands of dollars, all set aside to handle medical costs not covered by insurance.

Benefits of the HSA

An HSA is yours. Your balance can continue to build over the years. Normally you’ll get a debit card that is quite convenient to use when paying medical bills.

In some regards an HSA is superior to the well regarded Roth IRA as an investment because HSA contributions are not only income tax free when you contribute to them but also tax free when you take them out for qualified medical expenses. A Roth IRA uses after tax dollars when you contribute.

But wait, there’s more. Much more. HSA’s are also payroll tax free when you contribute. That means when the funds are withheld by your employer for contribution to your HSA you won’t pay the 6.2% social security tax or the 1.45% medicare tax. In other words, you save income taxes and payroll taxes on your HSA contributions. That’s a double bonus.

Turbo Charge your HSA

If you really want to build your HSA balance faster, you can do a few things to increase your savings rate.

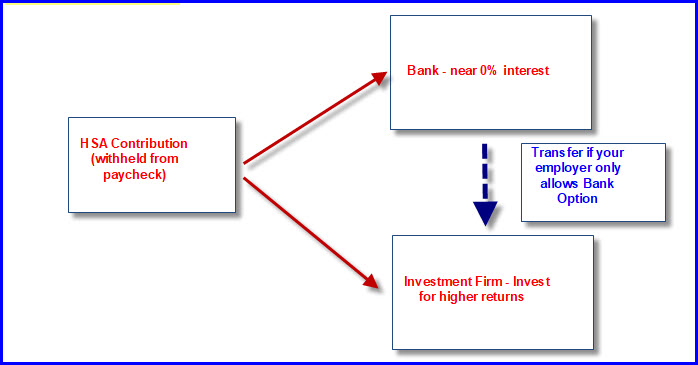

First, you can house the money in an investment account. With this type of account you can hold stock, bond and cash equivalent funds. This is superior to putting the money in a bank account that pays you almost nothing. By investing the money your contributions can grow to a substantial sum over time.

By properly diversifying your HSA investments you can minimize risk and grow your balance with a good rate of return. You can go more conservative or more aggressive, the choice is yours.

Sometimes an employer will set you up with their default HSA with a bank. Most will allow you to hold your HSA account elsewhere, but you need to ask. If your Employer does not let you contribute to an HSA outside of their bank default account, you can still move the money to an HSA provider you choose by doing a periodic direct transfer of HSA funds from the bank HSA to your chosen HSA account.

One low cost provider that let’s you invest the proceeds is Fidelity Investments. If you choose a company like Fidelity, and you can avoid spending all the HSA now, the remaining amount will grow just like a well balanced investment portfolio.

Hold off taking distributions if possible

Another technique some use is a unique feature of an HSA that does not require you to take money out of your HSA in the year the medical expense is incurred. For example, if you have a $200 doctor visit not covered by insurance or within your deductible you can choose to pay that bill out of pocket, and keep the receipt for a future HSA reimbursement rather than using your HSA now to pay for it.

Then, if you wish, years later you can reimburse yourself the $200 out of the HSA using the receipt as support for your qualified withdrawal. Why do this? Well, if invested, the $200 in this example can grow over the years to a much larger amount.

For example, at a 6% annual invested return, the $200 would grow to about $250 in four years. You could then take out the $200 using the medical receipt as support and the extra $50 will still be in the account. In other words, the longer you can leave the funds in the invested HSA the larger the balance will grow to become!

HSA Example

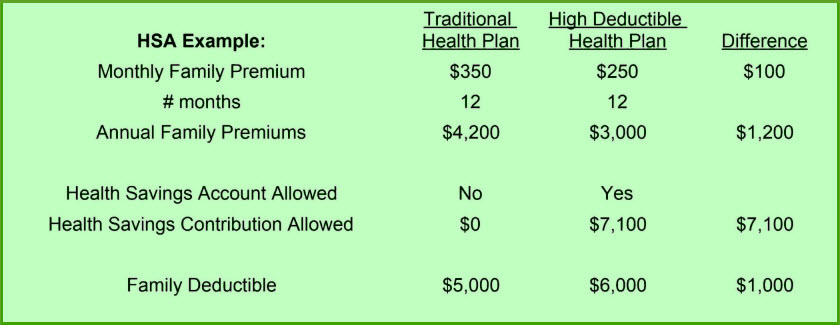

Here is an example of how you can transition from a traditional health plan to a high deductible health plan with an HSA.

Let’s say you have a family plan and your employer allows you to participate in a traditional health plan for $350 per month or a high deductible plan for $250 a month.

If you choose the High Deductible Plan you are then also allowed to contribute to a Health Savings Accounts (HSA). In 2020 the maximum family HSA contribution for the year is $7,100 ($3,550 for an individual). You can pick any amount from zero to the max allowed contribution and have the amount withheld over the year with your paychecks.

Let’s say for this first year you contribute $1,200 to your HSA, which is the premium savings by picking the High Deductible Insurance Plan. That means that your total contributions between the plans is the same [Traditional premiums = (High Deductible Premiums + HSA contribution)]. However, you now have up to $1,200 in an HSA account at the end of the year depending how much you use. If you are able to put in more than $1,200, that is even better!

Watch your savings grow

Suppose in this example you continue to put $1,200 per year in your HSA and you spend $500 on average a year out of your HSA for medical expenses. That means you’ll still have $700 left in your HSA each year. If this is a typical year you would have $7,000 in an HSA account in 10 years. If you invested the HSA earnings at about a 6% return per year you would have over $9,000 at the end of 10 years. Wow! Big difference compared to someone who was only in a traditional plan.

In Summary:

If you choose a qualified High Deductible Health Plan you can contribute to an HSA.

1. An HSA is your asset to use for medical expenses.

2. You do have a higher deductible with an HSA so review your medical expenses and make a decision you are comfortable with

3. Your contributions to an HSA are income tax and payroll tax free!

4. You can invest your HSA and it will grow even faster. Investments have risk so be sure to pick the investment mix that you are comfortable with.

5. One way to transition from a Traditional plan to a High Deductible plan is to invest the premium difference in an HSA to get your account growing

Something to think about before your next open enrollment!