I recently finished the book Atomic Habits by James Clear so I thought it would be appropriate to apply the salient points to personal finances as there are some good gems in this book.

If you have not read this book it is worth it. The first chapter is nothing like I expected, as the author goes through how a life threatening injury changed the trajectory of his life and how habits allowed him to get back on track and become successful after such a major setback.

Habit Stacking

The author explains one technique called “habit stacking” that can be a tremendous asset to anyone trying to implement and sustain good habits.

Habit stacking is essentially the back to back stacking of habits (no limit to the amount of stacking) that we do in a specific order at a specific place and time. This builds a kind of habit muscle memory where you get used to the process which makes it easier to implement and sustain without a lot of effort to remember.

If you think about it, most of us habit stack our morning routines on work days. Yours might be something like wake up – take a shower – get dressed – walk the dog – eat breakfast, etc. The idea is that you stack the habits that allow you to be efficient and successful by consistently performing your important habits.

Apply Habit Stacking to your finances

One of the issues that I believe exists for many is that we don’t have consistent habits for learning and taking action for our finances as we have for other aspects of our lives such as exercising or doing routine maintenance tasks such as cutting the lawn every week.

Habit stacking might be another way to apply a weekly ritual for your finances. For example, on a specific day of the week (say Saturday) you might always pay bills, check your investments and dedicate some time to financial educational (by reading a blog or article or listening to a podcast) after you have your morning breakfast.

So in this example the habit would be [Saturday breakfast] + [pay bills] + [check investments] + [financial education]

In other words, rather than haphazardly performing these financial activities when you get around to it or when it really must be done, you build a weekly habit to do it every Saturday after you have breakfast. This is just an example but hopefully you get the concept. After a while it should become automatic to do the one habit and then the other stacked habits that follow in sequence.

According to the book, even better would be to make the habit more attractive by adding something fun at the end. For example, you might stack spending some time on social media at the end of the stack with your favorite cup of coffee.

So in this example the stacked habit with an attractive reward at the end would be [Saturday breakfast] + [pay bills] + [check investments] + [financial education] + reward [go on Facebook while drinking your favorite coffee].

Having a weekly routine such as this example will reduce financial stress in your life because you now have a process in place to handle these financial tasks. The book teaches you to focus on the process rather than the goal and the goal will take care of itself.

The process would be to stay on top of your bills and upcoming expenses, check the status of your investment progress, and to keep learning more about personal finance. The goal would be to have a stable and secure financial life with a bright financial future.

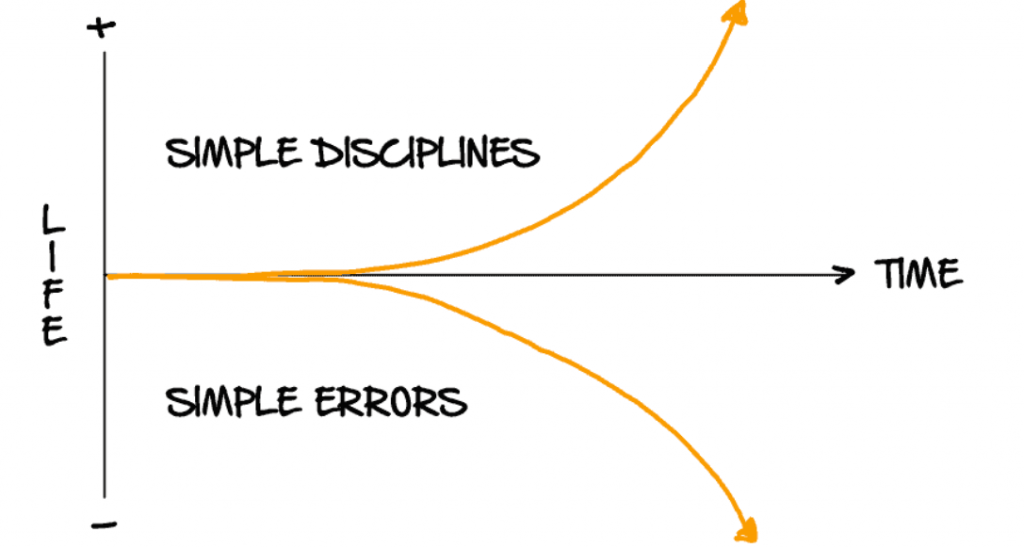

Too often people give up because they don’t see improvement

I love the ice cube example in the book. You start with an ice cube in a room at 25 degrees. Over time you slowly add one degree to the room temperature. You then get to 26 degrees, 27 degrees, 28 degrees, 29 degrees, etc.

Time passes yet no change to the ice cube. You are in what the book calls the “valley of disappointment.” As humans we expect to see linear improvements for our efforts, but that is often not the case. This results in many people quitting because they don’t see results.

But for those with the patience and perseverance to push through…30 degrees, 31 degrees…and then 32 degrees the ice cube begins to melt.

You can apply this non linear concept to sticking to an exercise and diet plan, or in the case of finances, sticking to a weekly routine to improve your financial life. This might include taking one action each week to make a small improvement.

The idea of incremental improvement (just 1%) consistently over time results in huge gains over time. It’s like compound interest, where you see little benefit for quite a while and then once the compounding gets going you finally see and recognize massive improvements.

I love the general saying, “it takes 10 years to become an overnight success.” This is exactly the point. No one really realizes the improvements until you’ve arrived, but it was years in the making.

Incremental improvements that add up to big gains over time is not a new concept. Another good book called “The Slight Edge by Jeff Olson” also promotes this concept loud and clear.

Actually our website here is based on this exact principal, which is if you regularly learn and apply financial tools and information, you will get control of your finances and have a more secure financial future!

For example, say that you read one financial article a day. After a few months you would have read about 60 articles. At this point your newly acquired knowledge might not bee too noticeable by you or others. However, if you stuck with it and read for a year it would be 365 articles. After two years it would be 730 articles. You bet you would have a lot of knowledge then!

You just have to push through the “valley of disappointment.”

Summary

Atomic Habits is a good book to consider reading that provides some great insights on how to establish and maintain good habits

Habit Stacking is a great tool to use to batch your good habits together for efficiency and momentum

Regular marginal improvements result in big gains over time. This concept is also described very well in the book The Slight Edge.

Apply regular habits to your finances and financial education and you too will see a massive improvement over time! You need patience and perseverance to make it through the valley of disappointment.

Resources