With a few months to go, you can still adjust your withholding with the federal government to avoid a large underpayment or a large refund.

Ideally you would check your tax situation a few times per year, but better late than never!

Avoid a large underpayment penalty

If you are too far under-withheld this tax season, you could also be subject to an underpayment penalty. Ouch! Why give your hard earned money away on a penalty?

The best goal is typically to have a small amount due with your return, but not too much, and not a big refund. I’ll explain the refund reason later.

Turn in a new W-4 form to your employer

You may have remembered that you filled out a W-4 form when you started your new job. This was needed to set you up in the payroll system with your desired federal tax withholding.

You’ll typically need that same W-4 form anytime you want to change your withholding. You can turn one of those in anytime you want to make a change. The change should be effective with the next available payroll.

However, if you do a calculation and you know you need to adjust your payroll withholding up or down a certain amount, your employer would typically have a process to just make that adjustment. This is much easier than going through the W-4 form process. See your payroll or HR department for your options.

Get the IRS Form W-4 here.

Be sure to adjust again in the new year

If you do make an adjustment to your withholding (either increasing or decreasing) during the year to get back on track, you will need to reset the withholding again early next calendar year. Why? Ideally you want to set a withholding amount that gets you to the right number by the end of the year. Your payroll or HR team will just carry your latest withholding elections from last year into the new year. It is up to you to make the appropriate adjustments to have the correct amount taken out.

For example, if you asked your payroll or HR department to withhold an additional $50 of federal tax per pay period starting in October to get you on track before the end of the year, they will continue to withhold that extra $50 per pay period in the new year too. You would need to adjust that so you don’t have too much withheld in the new year.

Why you don’t want a large tax refund

If you overpay your taxes, you are putting yourself in a position to receive a tax refund. If you overpay too much you may end up getting a large tax refund.

Some people celebrate this and treat it as found money. The reality is that a large refund is not found money, it is your money. It has always been your money. You overpaid all year and now you are getting your money back.

Essentially you gave the government an interest-free loan to hold your money for months and then give it back to you. Doesn’t sound that desirable, now does it?

Taking just a few extra minutes to run a calculation is all you likely need to dial in your expected federal tax a little better. We’ll walk through a few options further on in this article.

The other reason you don’t want a large refund is to reduce the tax fraud risk of someone filing a return masquerading as you. If someone pulls off that common fraud scheme, your return will get flagged since a fake user already filed a return using your social security number.

You’ll spend months trying to unravel that mess to prove to the IRS that your return is the legit one. Meanwhile you wait and wait for your refund.

The takeaway is to file your return as early as possible to beat a potential fraudster from filing ahead of you. If you have a small tax liability you can just pay the bill and square up with the IRS. If you have a small refund you at least won’t be out a lot of money while you wait to clear up the mess.

Avoiding a Prepayment Penalty

Ok, let’s talk about how to do a quick calculation using your last paycheck.

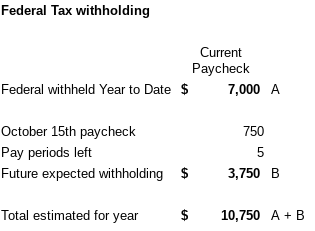

Let’s say you are paid semi-monthly and you have your wage statement as of October 15th. That means you have five paychecks left for the remainder of the year (Oct 31, Nov 15, Nov 30, Dec 15, & Dec 31).

On your October 15th pay statement there should be a Year to Date (YTD) section that should have your wages and taxes withheld so far in the year. How much does it say you paid in federal taxes? Let’s say that number is $7,000. Now what does it say the amount was for you current pay period section? Let’s say that amount is $750.

So, in order to get a rough estimate of how much federal tax you would likely pay by year end you would take your Year to Date October 15th taxes paid plus the expected tax you would pay for the last five pay periods.

The math would be $7,000 + ($750 x 5) = $7,000 + $3,750 = $10,750. So, your rough estimate is $10,750 for the year. How does that compare to your tax return from last year?

One Internal Revenue Service rule is that you will not incur an underpayment penalty if you withhold at least 90% of your tax liability for the current year or 100% of your tax liability for the prior year. So, if you look at your return last year and your tax return had a total tax liability of $10,500, you should be in good shape to avoid a penalty since you expect to withhold more than 100% of the prior year tax liability.

If you have a recent pay statement and can find your prior year tax return, you should be able to do this rough estimate calculation in just a few minutes.

Getting an even more accurate tax estimate

In the previous section we showed how you can avoid a penalty by paying in at least the same amount as your prior year tax return. That is fast and easy.

As described, if your tax liability last year was $10,500 and you withheld $10,750 this year, you can avoid an underpayment penalty. However, what if your current year tax liability turns out to be $13,000? You would be significantly underpaid. No penalty, but you would need to come up with a big payment at tax time. What if your current tax liability turns out to be $7,000? You would be significantly overpaid, getting a large refund. Neither of these are desirable.

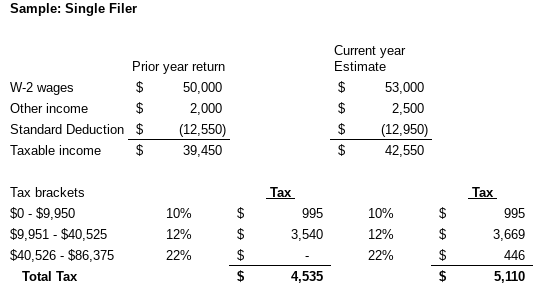

If you want an even better estimate of your liability for the current tax year, you’ll need to project your income and deductions.

To do this properly, you can start with the big categories from your last tax return in one column on a spreadsheet. Then, in the next column, you should project what you expect them to be in the current year. You can then determine your estimated tax liability by using the estimated taxable income and the tax rate that applies for your income levels.

If your tax situation is really complex you might need the help of a tax professional to get a good estimate. Most taxpayers with primarily W-2 wages and taking the standard deduction will be able to project their tax situation quite easily.

Using a tax estimate calculator

To makes your estimating easier, there are free tax estimate calculators available on the web.

The IRS website has a Tax Withholding Estimator that can help you come up with a more exact withholding amount.

Another site Calculator.net also provides a calculator. Try them both to see how much tax you might be above or below the expected amount.

Conclusion

Income taxes are one of the largest expenses you have. Normally we don’t pay much attention throughout the year as the withholding occurs on our paychecks.

We really pay attention in the next year once we figure out our tax bill or tax refund. By then it’s too late.

Take charge of your tax situation by running the estimates during the year. You should not be surprised by the results when your tax return is completed the next year!

Make it a game to see how close you can get your tax return to have a net payment of zero.

The point of this article is to remind ourselves to not wait until the big surprise at tax time, but rather to run a few calculations during the current year to know with reasonable certainty what the tax liability is going to be.

We know that neither a large refund nor a large liability are desirable. Following a tax estimate process will get you more accurate than ever.

Summary: There is Still Time to adjust your tax withholding this year

- A few times during the year it makes sense to review your withholding taxes and to project where you expect to be at the end of the year

- Ensuring your projected tax withholding is at least equal or greater than your tax return from the prior year is an easy way to avoid an underpayment penalty

- Once you calculate a better withholding amount for the rest of the year, notify your employer. Use the new form W-4 if they require it.

- Get a better handle your tax situation by running the estimates. You should not be surprised by the results when your tax return is completed!

- Using a withholding calculator such as on the IRS website or another website can help you estimate your taxes with even more accuracy

- Give it a try. Take charge of your tax situation. You’ll avoid unnecessary refunds, large liabilities and avoid penalties, as well as take the stress out at tax time.

Related Articles to Consider

- IRS forms 1099 and 1040: What are the differences?

- Employee guide to taxable mileage expense reimbursement

- Benefits of a Health Savings Account

- Take precautions to protect yourself from scam artists

- Yes – You can be a Student without a Student Loan!

- When does Fidelity send tax forms for investments?